Creative production and optimization is one of the things that many of my clients struggle with the most. User Acquisition (UA) teams are built with an emphasis on skill with data and knowledge of networks, and best practices - but creatives fall outside of these areas, and so are often neglected and handled as an afterthought. Many ad artists receive little direction or feedback, in many cases they’re contractors who don’t know or understand the product or its audiences. This is a great missed opportunity.

In UA one of the greatest levers that a marketing team has to improve Cost Per Install (CPI) is creatives - the images, videos, and associated copy and assets displayed in ads. The impact isn't limited to CPI, of course, but also retention and therefore LTV - but to a lesser degree than CPI. Nonetheless creatives and creative optimization are one of the most neglected areas in most of my clients' marketing programs. It requires creative thinking and a lot of "going with your gut" because no data can ever truly answer the question of what kind of ad creatives will best resonate with your audience until you've tried them. This can be especially challenging for UA teams whose job revolves around data driven decision making using hard numbers provided by direct marketing channels like Unity, Iron Source, Meta, etc.

The bad news is that even under the best of circumstances there will always be a lot of ambiguity around figuring out what creatives to produce to reach the audience that will love your game.

The good news is that there are plenty of ways to reduce - never remove - this uncertainty and help answer the question "out of every possible video I could make, which ones should I spend my budget producing?". These tools include audience surveys and testing, looking at the results of past creatives, and the topic of this post- ad intelligence and analysis of competitors' creatives.

Step 1: Understand the limitations of this approach:

Looking at competitor ads is useful because it gives you hints about what has resonated with your target audience and what has not. It does not tell you what brand new concepts for ad creative will woo your audience, although if you involve your creative team in your analysis it may inspire them with ideas that are worth testing. In other words this process of competitive ad analysis will provide a jumping off point, and some guard rails, and insights into your audience’s potential preferences. Creativity and originality will still be needed to make the versions of ads that will work for your game, and some iteration work and consideration of constraints will be needed to refine them.

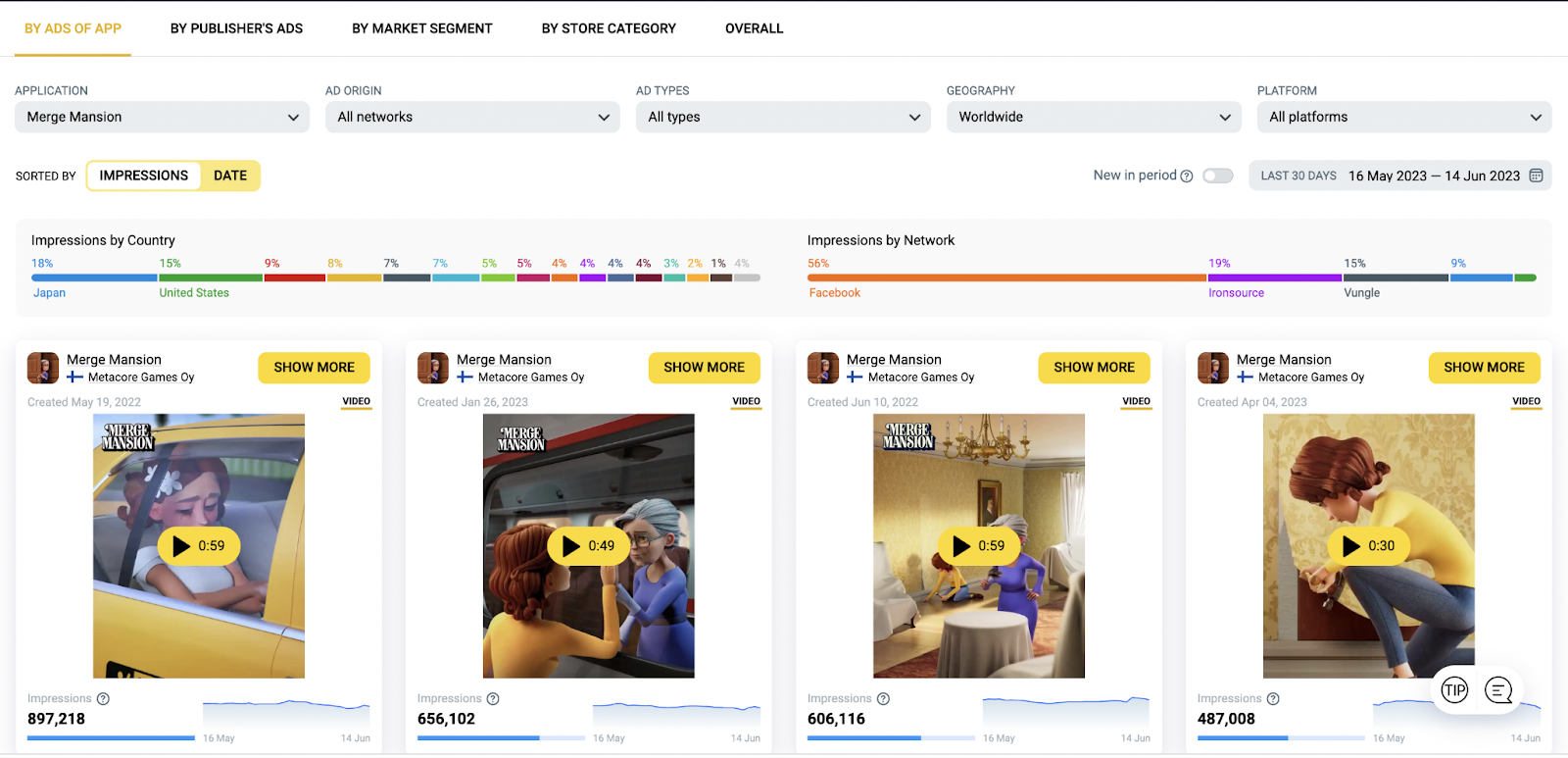

Constraints as a guiding part of your process: Merge Mansion is the top of the merge 2 genre. One thing that would jump right out at a creative producer is the fact that all of these games are original 3d animations - a pretty pricey ad format. Knowing that this has helped a competitor is of little value if you can’t do it, so to look for other tactics take a zoomed out look at the whole genre.

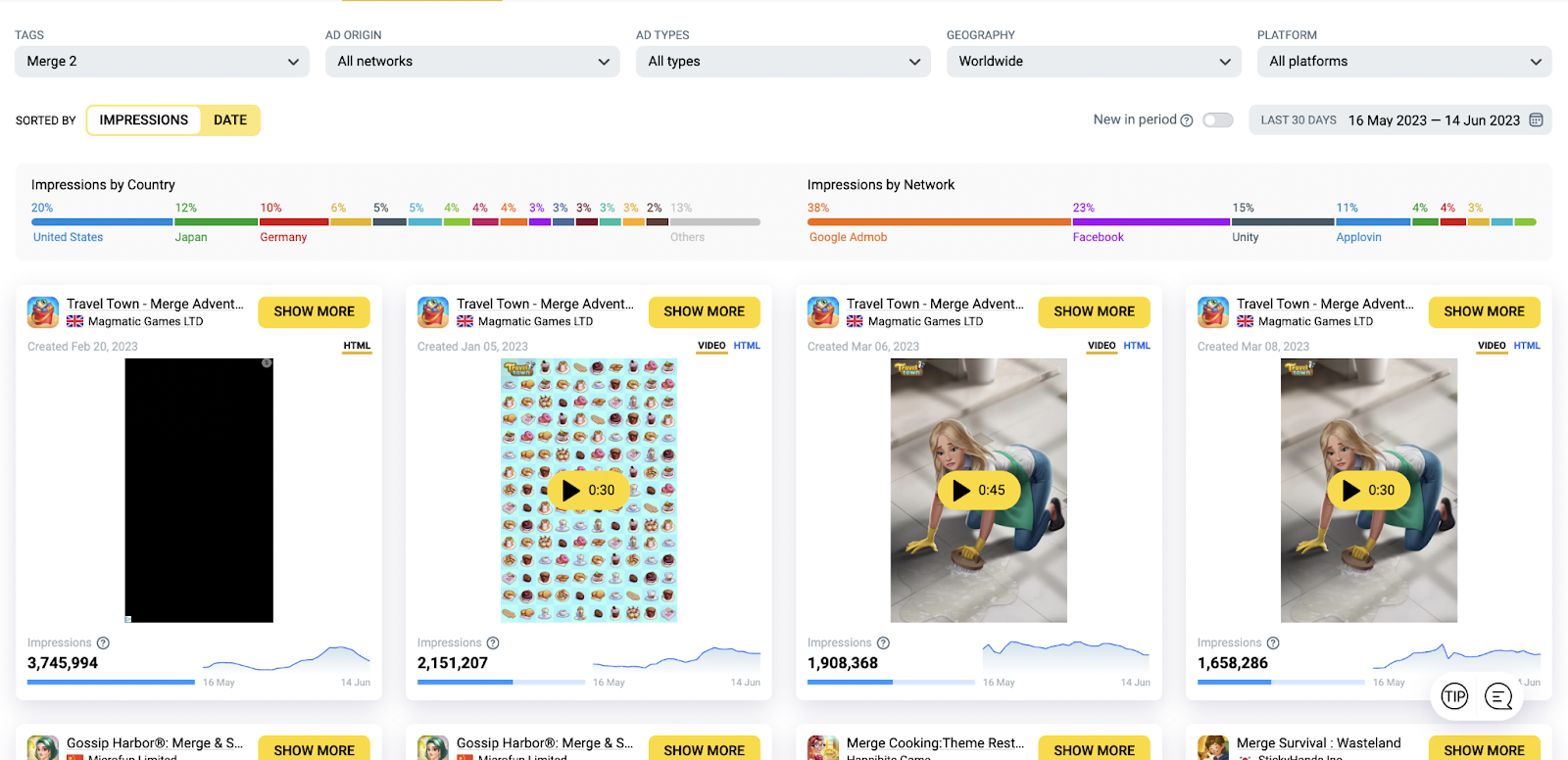

Popular creatives for Merge Mansion:

Popular creatives of the whole match 2 genre:

Step 2: choose your tools:

There are a variety of data tools that do different forms of ad intelligence. The most basic is Facebook / meta itself and their free ad intelligence tool. They don't offer a ton of data but you can see what ads competitors have run and you can extrapolate to understand which ones are the most successful. At Mobile Game Doctor we use AppMagic, which will be used in my examples below (full disclosure, we have a partnership and ongoing relationship with AppMagic). Some of the most useful statistics that are widely available are impressions per ad, network, and geo data, as well as trendlines over time.

The basic premise that this approach operates on is that if your competitors are spending on an ad that it probably is performing well broadly in terms of CPI, user install quality, IPMs, and/or various other metrics that are uncontroversial as key performance indicators (KPIs).

Sidebar: Ad intelligence tools are also valuable for other types of creative ideation methods. If you have an idea for an ad based on some factor other than competitor ads (product pillars, pop culture, audience feedback, an artist’s random idea, etc.) it can save time, energy, and testing cycles to look for those ideas first in your competitions’ ad libraries looking for similar ads that *did not* do well and de-prioritize those.

Step 3: know your competition AND know your neighbors

Chances are you already have a list of competitors. Choosing the right competitors to compare to is a complicated topic that we can only scratch the surface of here, but there are some general guidelines that can be stated simply. Three or four is usually enough to provide for a robust analysis of competitor creatives, depending upon the volume of ads and the number of competitors but the more specific you can get the better. You don’t want to unintentionally compare apples and oranges.

You can and should update your competitors periodically. You should choose games that are dominant in your genre, or that have value propositions that are similar to your own. Chart topping games can teach you about your broader audience and their preferences, games lower down on the charts that have a lot in common with your game can teach you about how people might respond to your particular game and ad creative within that genre. If you’re not sure you can often search app stores for genre, or use services that show categories for a particular product.

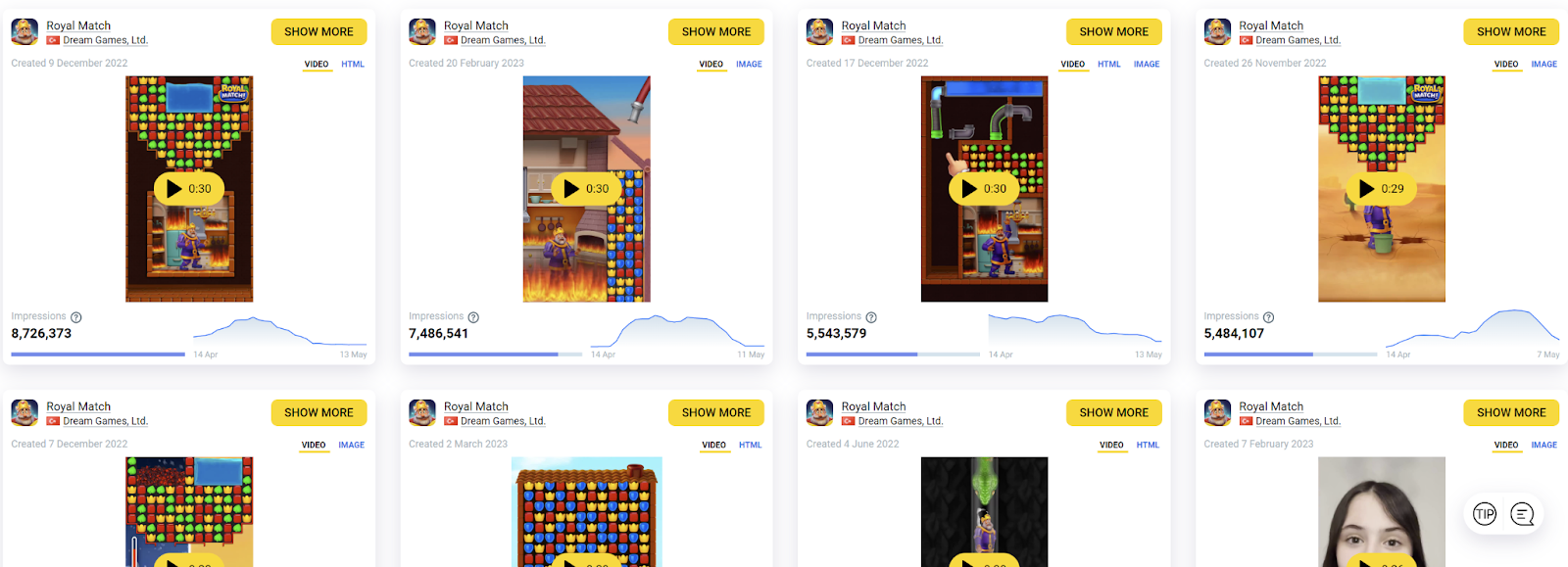

Step 4: review competitor creatives:

This is where a premium tool can make your life a lot easier. Look up your competitors one by one and give yourself a 3 to 6 month timeframe for your data. Note which ads or types of ads seem to be doing well - how long have they been running, how much traffic do they seem to be getting, are multiple versions of very similar ads being made? What networks and geos are different ads running in?

It can be really helpful to do this and the next step with an artist or creative marketing pro who understands how to quickly deconstruct ads and can spot common design elements or production trends that might not be easy to identify by a casual observer.

Try to be disciplined about not going too far into analysis at this stage. Try to approach this review with an open mind and just note what you see. This could mean picking some top performing ads for each competitor, marking down relevant data like networks, geo, and impressions, and then watching each creative a few times and making up tags. Does it show gameplay? What’s the call to action? Does it use 3d animated characters? Is there a lot of text? VFX? Try to write short bullet points for each. If you note an element in one ad after reviewing others it may be necessary to go back and see if it’s present or absent in others.

Time permitting spend a few hours on each competitor gathering this type of data by watching their ads and looking for trends.

Step 5: hypothesis and creative production/testing:

The rubber finally hits the road, so to speak, when you have completed your analysis and identified some trends and characteristics in ads that perform well and ads that don't perform well. Looking at all of your analysis you should be able to make at least one or two statements like "ads that show gameplay are more popular than 3D animations in this market", or "ads that show characters early perform well" or from the artist helping you "ads with mostly warm colors do well". Once you have one or two of these you feel is strongly supported by what you are seeing in the competitive data it's time to hand it over to an artist or creative lead to come up with some ad concepts that test these hypotheses. The fine art of creative testing is a topic for another post, but do be sure to produce multiple versions of ads that you think have a strong hypothesis behind them. It's very hard to tell what parts of your ads are actually resonating with your audience or even driving them away and it would be a shame to miss out on an opportunity to make some great creatives because you showed a character that your audience didn't like the looks of in the first three seconds of a video that would have performed well with a different character, for instance.

Conclusion and final notes:

There are a couple of topics that naturally come up when doing this kind of analysis.

Cloning ads -

Is a big question. Clients who do competitive ad analysis have often made close copies of ads they think are successful. This isn't a bad idea as long as you can meet or exceed the quality of the original ad. You also are likely to end up in a bidding war with the original ad creator - after all you are hoping that your ad will appeal to the same audience on the same channels for the same type of game!

Learning from your neighbors

- is also a valuable way to get to ad concepts that have been somewhat vetted. This could be step 3.5 in the sequence above. In addition to direct competitors, who you should know well and keep a close eye on, you can also look at related genres outside of your particular niche. Your audience research should give you some hints about which related genres are likely to have the potential for crossover. Go through the same process above but look at other genres to identify creatives to use as inspiration that you think would also resonate well with your audience. Within your ad ecosystem/genre niche you may be able to stand out with some novel ads from concepts that have been vetted for you for games with some similarities.

This is an iterative process and you should consider this method as one to return to periodically. Most performant creatives have a lifespan and eventually will be replaced by some other style of creative, making new opportunities for you to learn on your competitors' UA dime. While you’re waiting on new competitor ads don’t forget to look at your performant ads and try to iterate on them in order to improve, and try out original concepts on a regular basis using whatever inspiration you can find.