Mobile Game Doctor and AppMagic’s partnership goes back to 2016 and we have been extremely fortunate to have access to the depth of market intelligence data that AppMagic provides for the Mobile App/Game market during that time. So, I was certainly thrilled when they asked me to review their most recent Casual Mobile Gaming whitepaper for H1 2023 and provide additional insights.

The first thing I would point out for context on

Casual Mobile Gaming whitepaper for H1 2023 is that is a historical analysis. In 1948, Winston Churchill paraphrased philosopher George Santayana when he said -

“Those that fail to learn from history are doomed to repeat it.

–Winston Churchill”

I point this out because while there are certainly lessons learned from history, past success or failure is not a particularly accurate predictor of future success or failure. This article needs to be consumed with the perspective of learning from the past to try to avoid mistakes that were made and not as a template for future market behavior. I have often given advice that if you want to break into the mobile game top-10 top-grossing, the first thing you need to do is deeply study everything that currently holds a place there, and then do something completely different than everything else.

What follows below is a somewhat organized list of thoughts I have related to the information presented in

AppMagic's Whitepaper informed by the practical context of consulting on 20 or 30 games that were struggling in one way or another during this timeframe and the 6 months leading up to it.

Observation #1 - Casual Mobile Game Marketing/Distribution is Very Difficult

Success in the recent/current mobile casual game market is primarily driven by well executed marketing strategy. A fun game that is accessible, compelling, well-designed, with a strong live operations execution is “table stakes” for entry into the market, but many, many games with all those attributes have failed predominantly because the publisher (the entity driving the game business, which might be a separate company or might be the actual game developer), failed to execute a viable marketing plan.

Here is an example conversation I’ve had with a number of developer/publishers over the past few years:

Developer - “Hi, Mobile Game Doctor? We need better monetization in our game.”

Me - “Ok. How do you know?”

Developer - “What do you mean? We don’t make enough money!”

Me - “Enough money for what?”

Developer - “Enough money to market the game profitably so we can grow!”

Me - “Ok. What is your ARPDAU?”

Developer - “$0.60”

Me - “What is your D1, D7, and D30 retention?

Developer - “52%, 21%, 9%”

Me - “Those numbers are pretty good, actually…why do you think you have a monetization problem?”

Developer - Because we can’t get a CPI under $25!”

Me - “...sounds like a marketing problem.”

The above is a bit of a dramatization, but the point is that I’ve worked on a number of projects where the developer is under the impression that they have a systemic product-design-related problem, when in reality the issue is that they have a flawed marketing/distribution plan.

Today’s game performance marketing ecosystem is:

- Complex

- Crowded

- Competitive

- Overpriced

- Under-optimized (and difficult to optimize)

- Designed to maximize margin for the marketplaces

- Mostly misunderstood

Couple these factors with a relatively low barrier to entry into the market, and you end up with a pretty voracious mix of factors that effectively make it IMPOSSIBLE for any new game to succeed in the market without some kind of true marketing competitive advantage.

“The developers are still launching new projects at an insane rate: 258 in the past six months (compared to 80 in the Match-3 market). So, naturally, we see success rates plummeting from 3% in 2022 down to 0.8% in H1 2023; the market simply cannot cope with the sheer volume of games. Out of the 258 Survival titles launched, only the two above can be called successful.

–Casual Mobile Gaming whitepaper for H1 2023”

Many of the “failed” products in the market did not fail to build a compelling product - they failed to either:

- Foresee the amount of time/cost necessary to attain market-viable KPI

- Discover a genuinely market-viable USP

Aside: In free-to-play games, product development and marketing aren’t really two different things. They are two sides of the same ecosystem. This is a very important point and the single most misunderstood factor of free-to-play games, especially by folks with a strong background in “premium” game development

Observation #2 - The time/cost necessary to attain market-viable KPI

There was a time, long ago, where you could tell, within a week or two of a “soft” launch if a mobile game MVP (“Minimum Viable Product”) had success potential or not.

THOSE DAYS ARE OVER

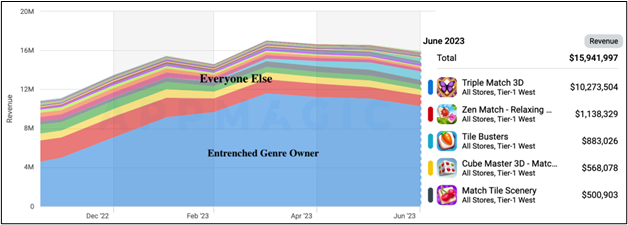

Here’s why: Most game genres and sub-genres are well explored. Many have at least one, if not more than one, established and entrenched competitors, as well as a number of less successful offerings.

It is very, very, very unlikely that a brand-new entry into the genre is likely to perform at the level of entrenched competitors with mature and optimized game systems and marketing engines. The functional economics of performance advertising practically make this a law of the universe.

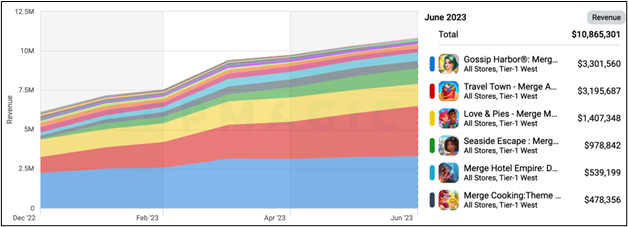

Image source

Casual Mobile Gaming H1 2023, annotations added

Teams that have been through this wringer and survived have learned that the process of globally launching a game has evolved.

Here’s a comparison:

| 2014 launch plan | 2023 launch plan |

|---|---|

| Build game core MVP in 4 months | Tier 1 concept marketability test to prove USP, likely CPI floor and degradation rate |

| Limited Tier 3 tech launch for 2 weeks | Build game core + meta MVP + live ops pipeline in 12-18 months |

| 4-6 week Tier 3 marketing-supported soft launch to gauge market viability | Tier 2 tech launch - 3 months |

| Global launch go/no | 6-12 months initial-market minimum-marketing launch with full live ops support to develop minimum competitive KPI |

| Launch everywhere | Scale marketing when KPIs align |

| Roll out new markets in priority order with +/- 3 month minimum-marketing support for each to prove viability in each market until you are live in every viable market |

What this means is that a developer needs to be prepared to not only develop the game, but also outlay both full-team live ops and marketing spend for 9-15 months after reaching soft launch before you start to see profitable return.

Observation #3 - Exceptions exist…but it’s NOT about the product… Usually.

Let’s examine a genre that has received a ton of attention this year: Merge Games.

There are a few of things to note on this genre breakdown:

Consistent growth of the overall revenue pie (rising tide)- Lack of any clearly dominant player, and (in particular) share growth for 2 of the three potential incumbents

- Continued POST-covid segment growth

All of this is important because it implies that the actual appetite/audience for this type of games continues to grow (vs. the previous Match-3 graph that showed substantial post-covid decline) AND nobody has quite figured out how to really dominate it yet. It will still be a fight for a new product, after all Carolin Krezner at Trailmix is really smart, but at least you are fighting 200 lb gorilla’s not one 1000 lb one, and the fight between the gorilla’s might leave an opening for scrappy new entrant with a proven USP and the marketing commitment to back it up.

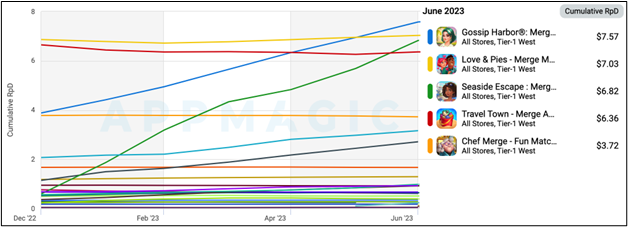

Keeping on the Merge Game theme - let’s look at one more graph to really highlight a markedly exceptional story:

So the two lines that really stick out here are Gossip Harbor and Seaside Escape from Microfun. Talk about rocketship growth. I already mentioned above that this genre was ripe for a new entry in the paragraph above, but let’s see what we can find out about how Microfun did it…

Profiling Microfun vs. Trailmix

| Trailmix | Microfun | |

|---|---|---|

| Titles in portfolio | 1 | 22 |

| All time revenue | $31mm | $304mm |

| Lifetime portfolio downloads | ~7,400,000 | ~302,000,000 |

| Operational History | 3 years | 10+ years |

| # of employees | Oct-50 | 200-500 |

Based on the above information, I’d hypothesize that Microfun analyzed the genre stratification and dynamics, identified a segment that was ripe for entry, then used their established audience and resources to outmarket everyone else in the segment to drive the growth we see in these two “exceptions”. They were even smart enough to enter the market with not one but TWO games, and capitalize on portfolio effects to grow them both more efficiently.

In analyzing a number of these “exceptions” that the driving reasons behind these product’s success comes back to superior marketing rather than superior product. This is not true 100% of the time, but for the last 5 years or so, I’d say it’s true 90% of the time.

These were my initial thoughts in response to

Casual Mobile Gaming whitepaper for H1 2023. I cannot overstate the value of

Appmagic (or similar market data providers) in giving even the smallest developer/publishers world-class historic market data. I hope this response gives some ideas of how market experience and contextual knowledge can enrich this data and provide additional insights as you chase greater growth and success. I love that Appmagic is committed to providing such additional context as a matter of course with ongoing analysis, breakdowns and insights through their ongoing investments in content for their

Articles page, as well as soliciting domain experts, like the ones at

Mobile Game Doctor, to provide commentary and input. To me, that represents a commitment to customer success that goes above and beyond their minimum mandate of up-to-date, accessible, and accurate data projections.

The market for free-to-play games is tough, and we can use all the help we can get!